Widget Works has been working towards a “Pre-Qual” calculator solution over a number of months which combines:

- Buying Costs

Property details, stamp duty and LMI - Multi-product repayment

With tags to filter the products based on the customer’s scenario - Borrowing Power

Extensive credit policy support

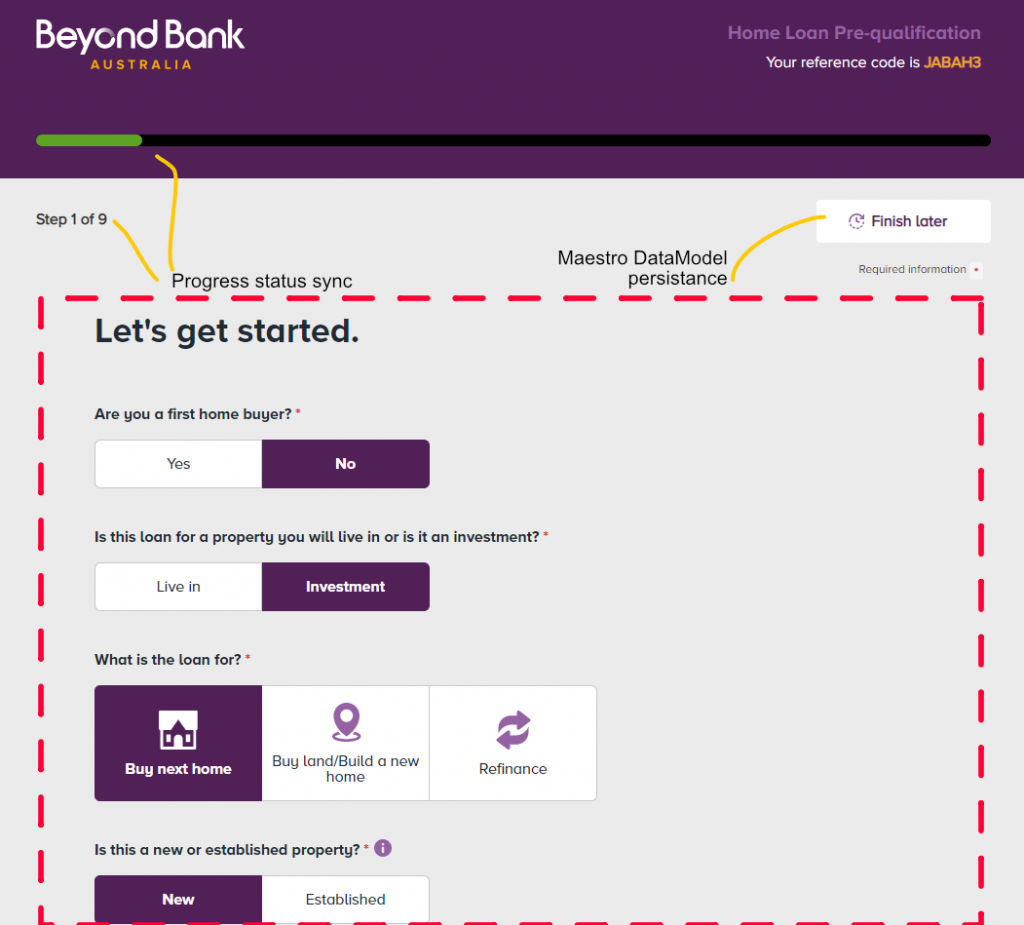

Beyond Bank have now launched the “Pre-qual” calculator, running as a native component in a Teminos Maestro Form. Widget Works created the component wrapper to interface with the Form’s native features:

- Maestro based auto-save

- Maestro save for later & restore

- Maestro datamodel integration once complete

- event interface to allow data transform and generation of email and CRM data from the Widget

This means Beyond Bank can adopt a fully maintained and testable component within their Teminos Forms and CRM (Dynamics) environment.

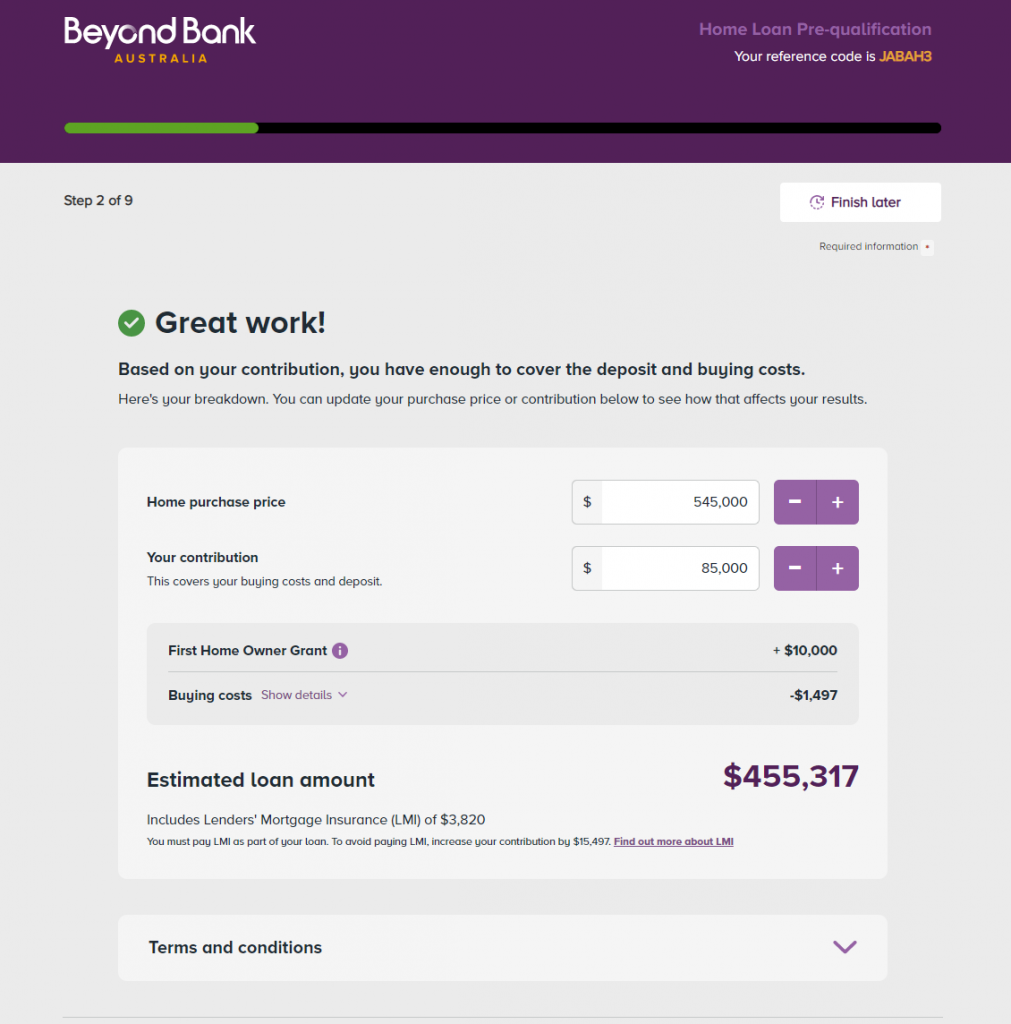

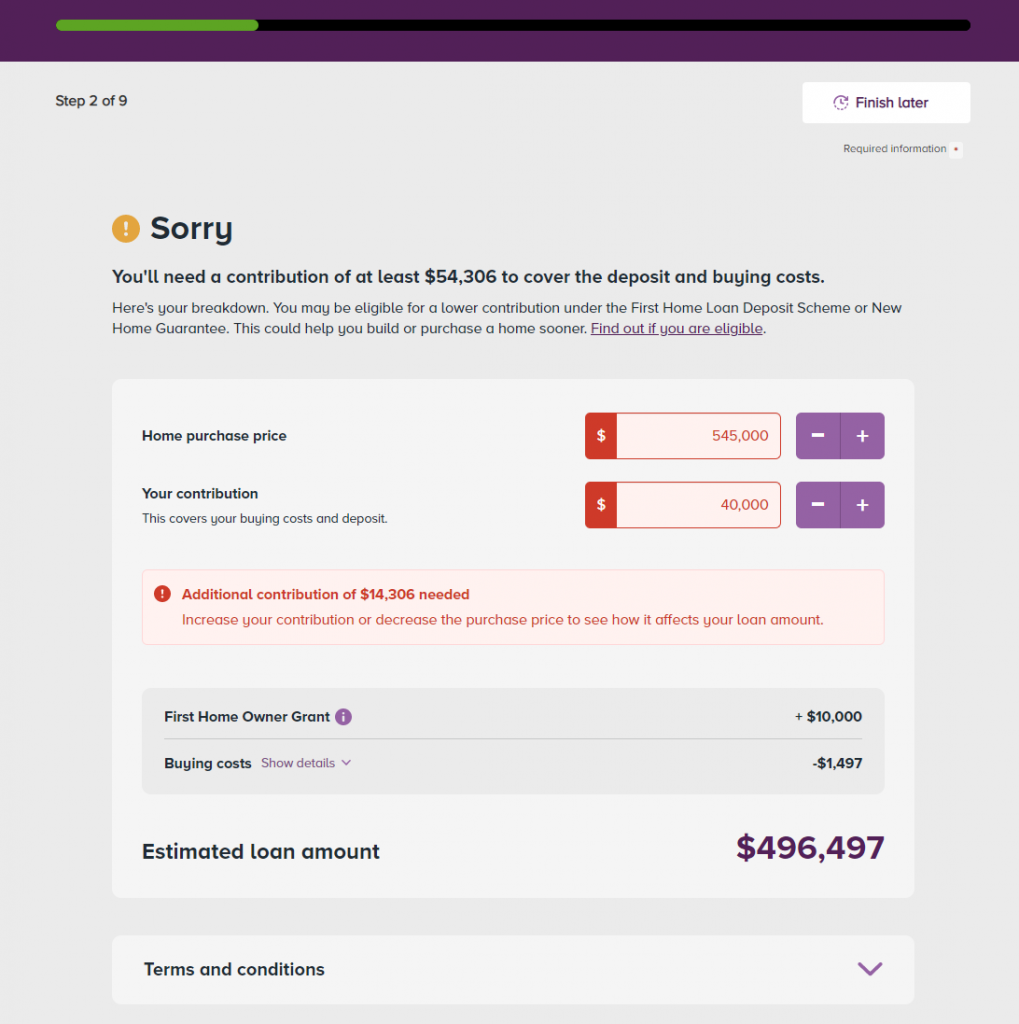

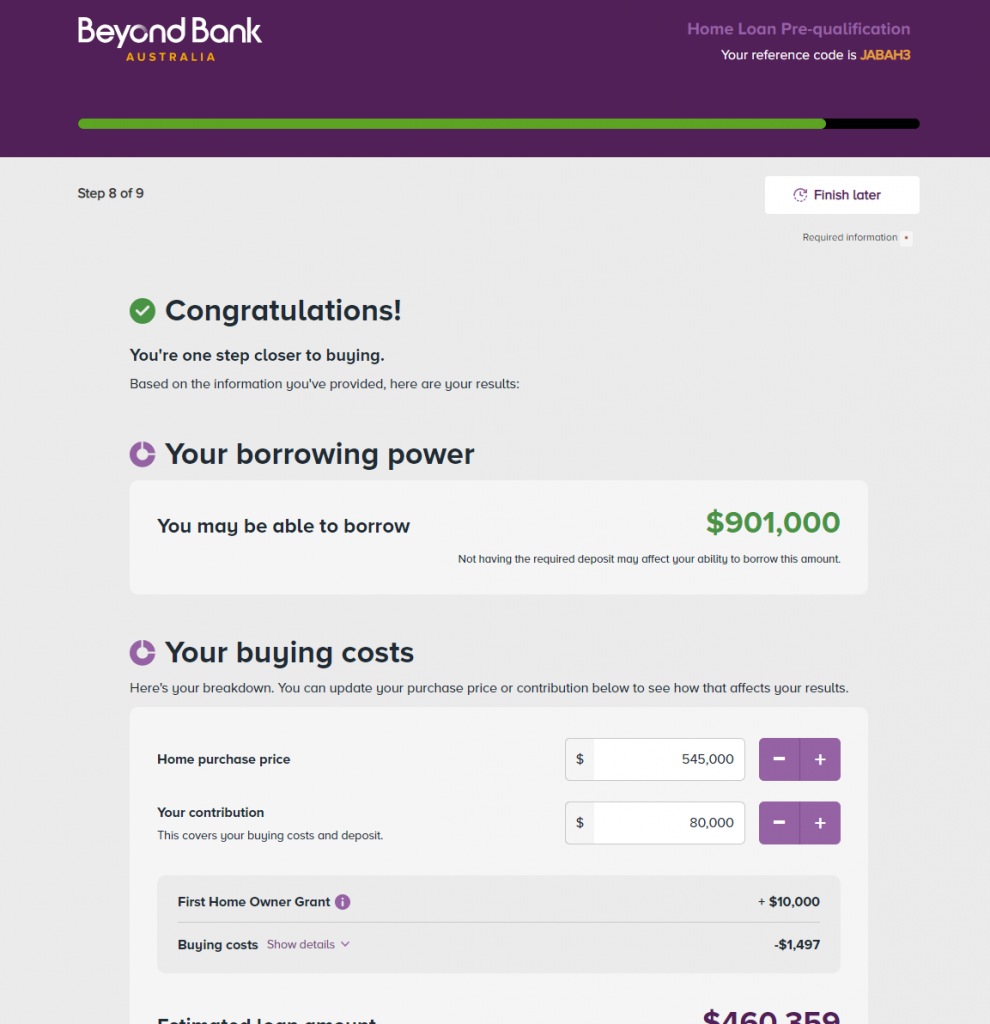

Buying costs + stamp duty

The application starts with a configurable question flow, address lookup and progresses to interactive results. Dynamic content customises feedback based on outcome + purpose (investment/owner occupied), FHO status, purchase type, LMI and if the deposit is adequate.

Solvers help users understand LVR effects on LMI and alternative deposit amounts to optimise for different outcomes e.g. minimum deposit required. Once adjustments are made, the user progresses to a pre-filtered set of home loan products.

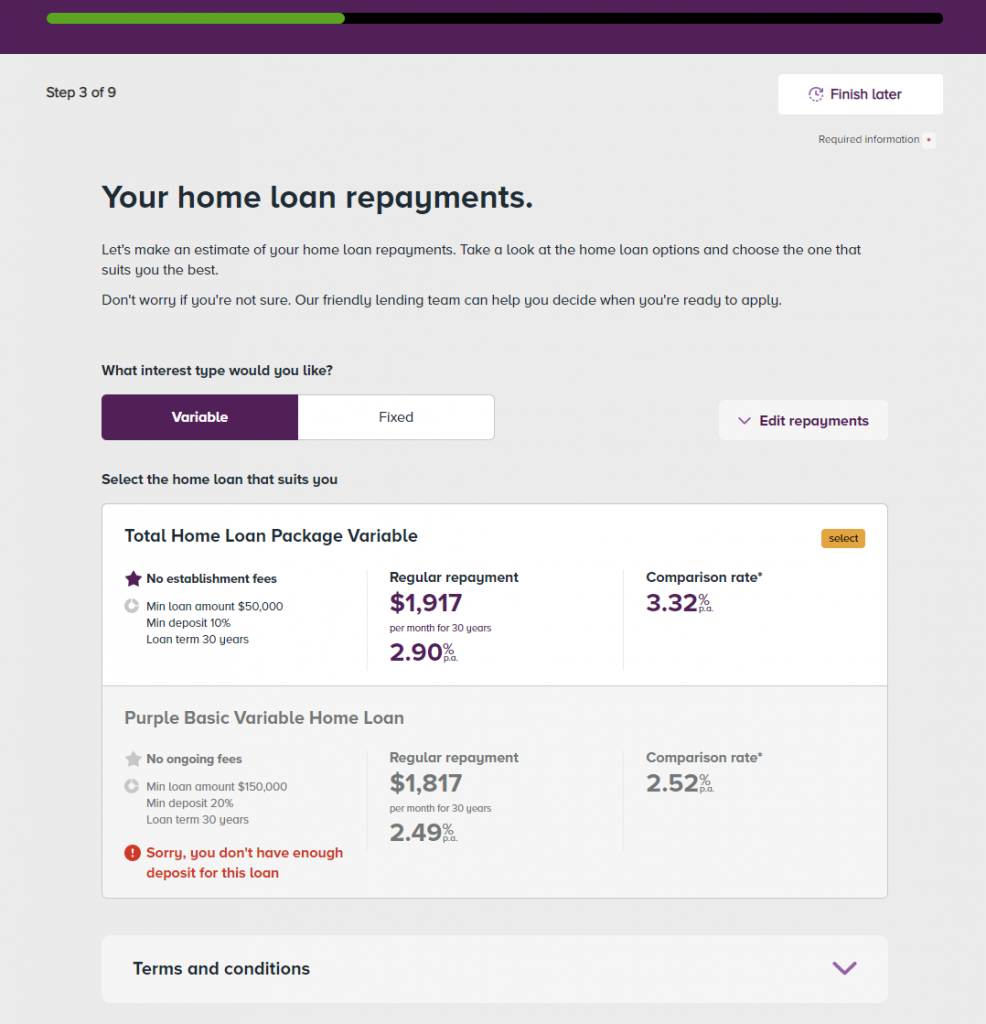

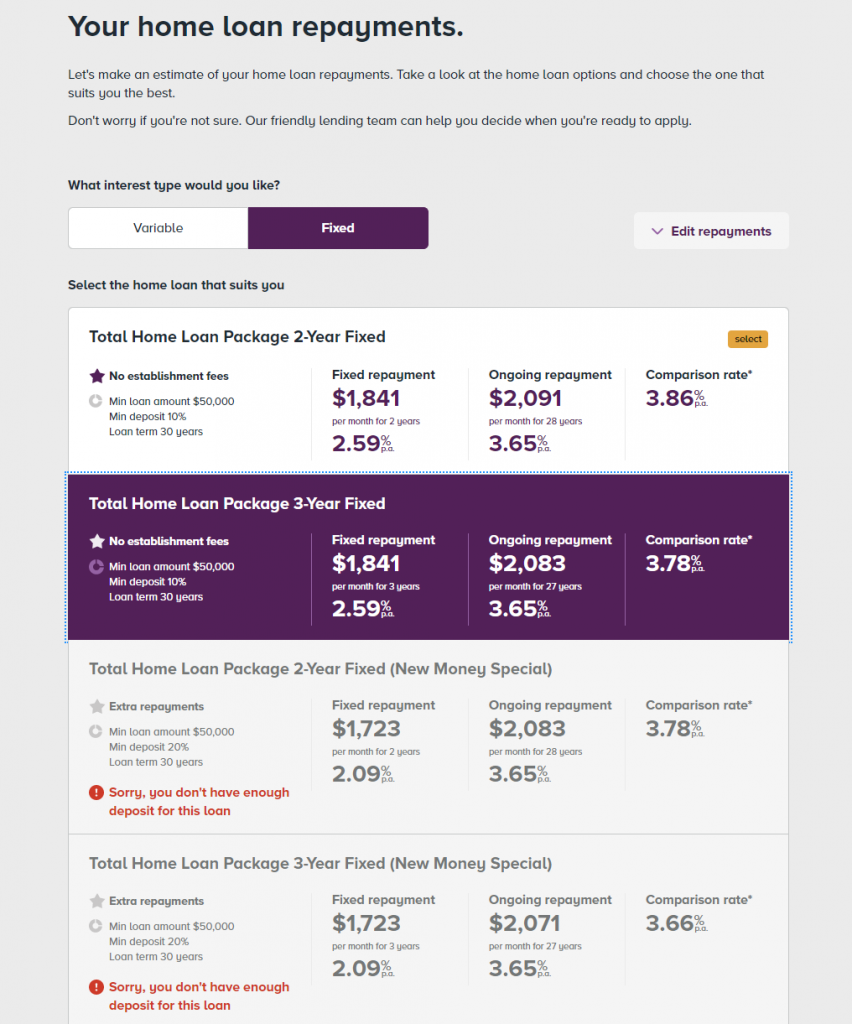

Repayment multi-product results with hinting

Full product support, now offers rate resolution & repayment results for multiple products so they can be immediately compared. Data derived product features are generated (min deposit, max LVR, etc) so they’re always up to date and combined with marketing content.

Hints when invalid states are present allow users to understand what other options might be available.

Borrowing Power

Now the all important servicing and affordability checks. The integrated Borrowing Power inherits the full credit policy assessment capability. It’s centrally managed and kept in sync with other calculators, so we ensure an identical outcome with Beyond Bank’s standalone Borrowing Power calculator.

When a user completes a Borrowing Power calculator scenario, the entered data (incomes, expenses, etc…) can be passed to Pre-Qual via an encrypted, time limited datastore so none of it needs to be re-entered when progressing on their journey.

Overview results

The overview stage pulls together everything a user has just learned and calculated. Primary values and outcomes can still be changed and even the product selection changed (with LVR and affordability effects catered for) before we hand back to the Maestro form for it to complete the transaction. Data and other outputs can be formatted for CRM ingestion and user email flows so everything is guaranteed to be maintained and kept in sync.

Widget Works Prequalification is a customised solution that builds on our calculators and experience to deliver a drop in solution. It’s configurable, testable and maintained along with all our other calculators.