ubank’s 2022 relaunch builds on the strengths of nab’s 86400 acquisition. The light, bright and modern look sits atop a deeper digital origination capability and there’s a new-feature laden Widget Works Borrowing Power too. As ever, we worked closely with their design team to create an integrated, mobile optimised experience that’s accurate and encompasses necessary amounts of credit policy.

This Borrowing Power release delivers features from our latest iterations and builds on our rich mortgage-product support. Since day one, we’ve supported LVR pricing and filtering with a focus on property value. Then we added editable-deposit support and now ubank’s Borrowing Power is running with our third version of the “mortgage triangle” (property value, deposit, loan amount) which allows far more configuration.

More help with deposits

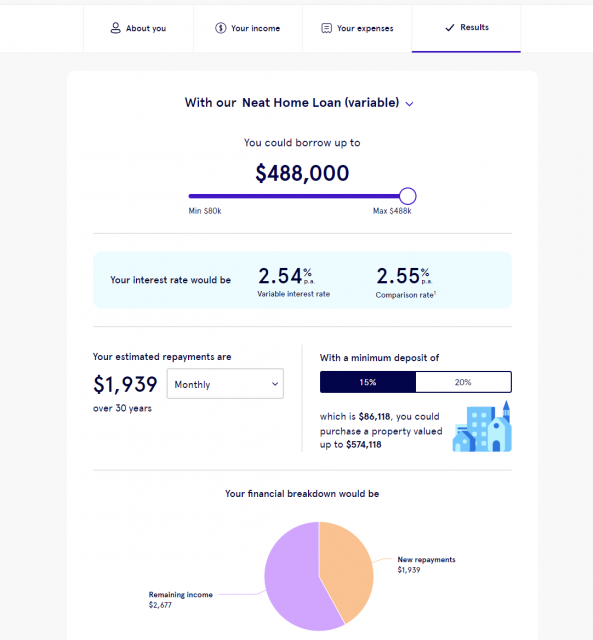

Starting with my favourite screen the results presents a colourful, branded page that’s easy to read through. It shows off the great rates and a clear answer to “how much can I borrow”. Deposits these days are so often the limiting factor on how much a customer can borrow so that’s a result as well (15% or 20% depending on the LVR in this case).

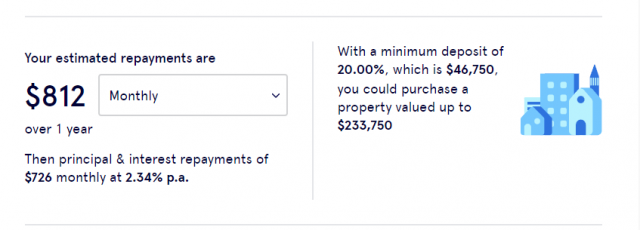

If however the user is an investor (a selection on an earlier screen), there’s only one deposit support in the products and so a variation is delivered in the results:

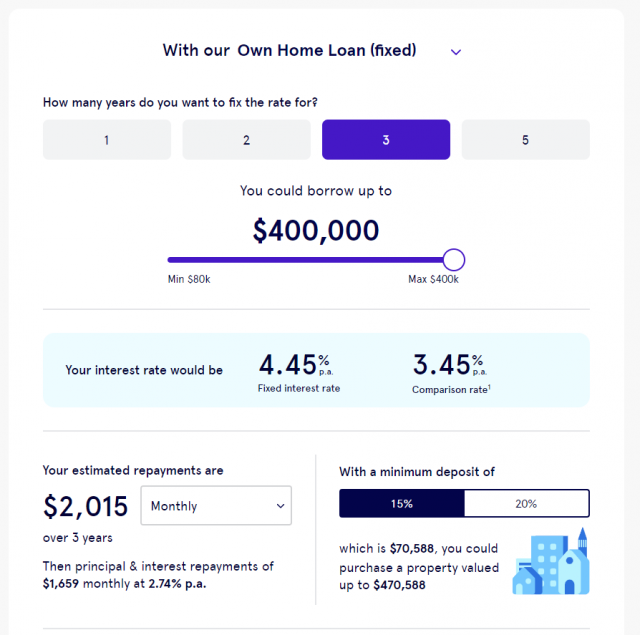

Fixed loans are presented seamlessly using our product family support and our condensed revert repayment presentation.

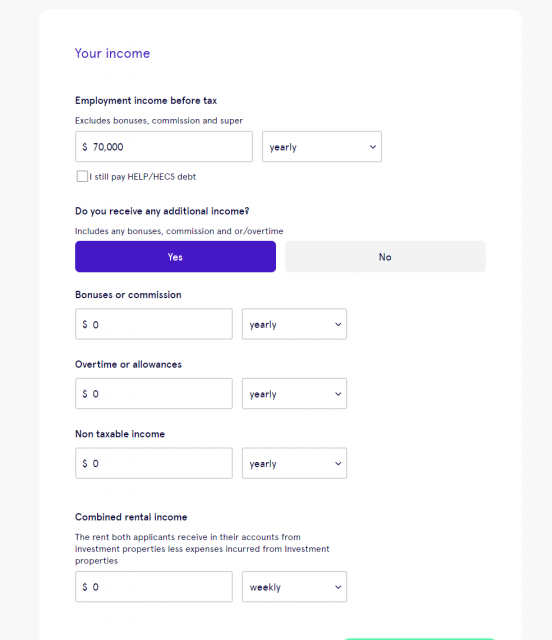

Jumping around a little, ubank’s income inputs make use of

- “native” HELP/HECs costs calculated from ATO tables (with optional DTI liability support)

- Yes/No selection for other incomes (a variation on one at a time and only-yes interaction options)

- and finally shared income spread over multiple applicants (rental income)

Borrowing Power now supports mixing and matching almost all these options in any combination.

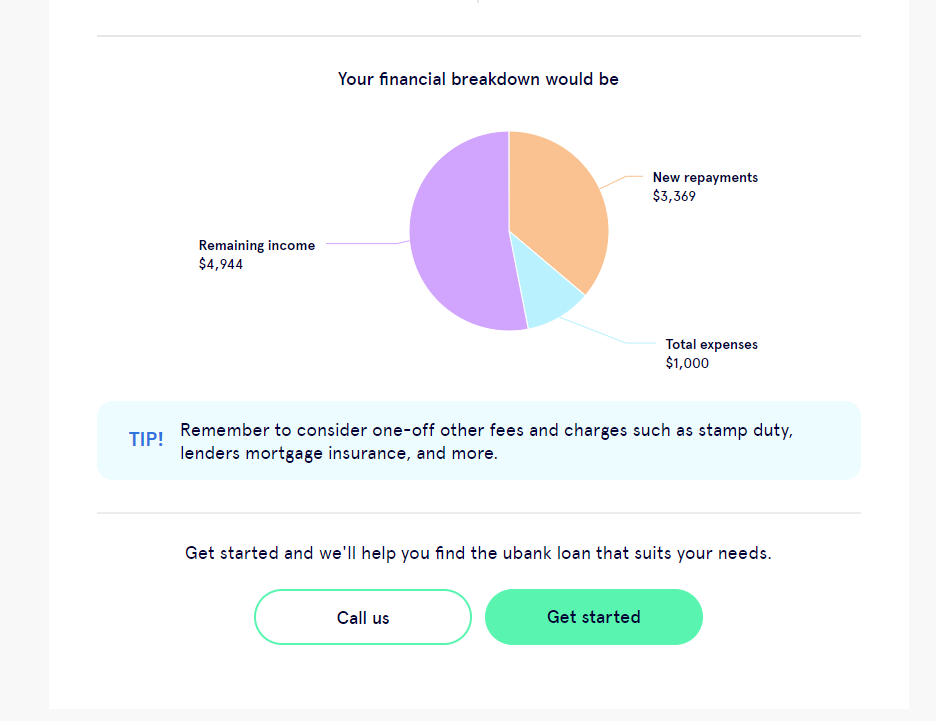

Finally, back to the end of the results. User entered values and the new loan repayments are presented with remaining income so borrowers can see the effect their proposed loan will have. Then there’s not much else to do except Call or Get started with an online application.

Congratulations to the team on a successful go live of a great looking and functioning site.